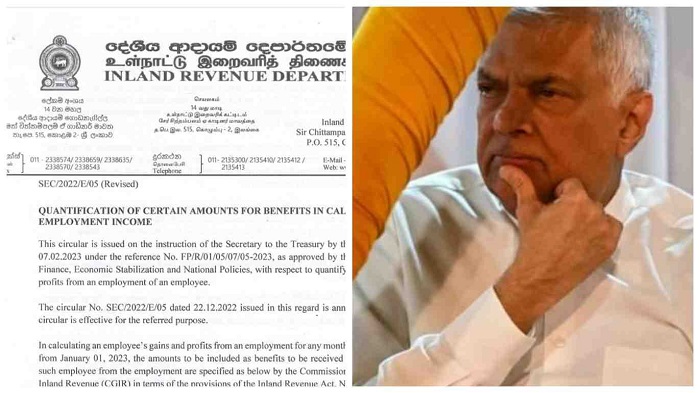

The Department of Inland Revenue has issued a revised circular pertaining to the relaxation of certain incentives provided at employment for an employee.

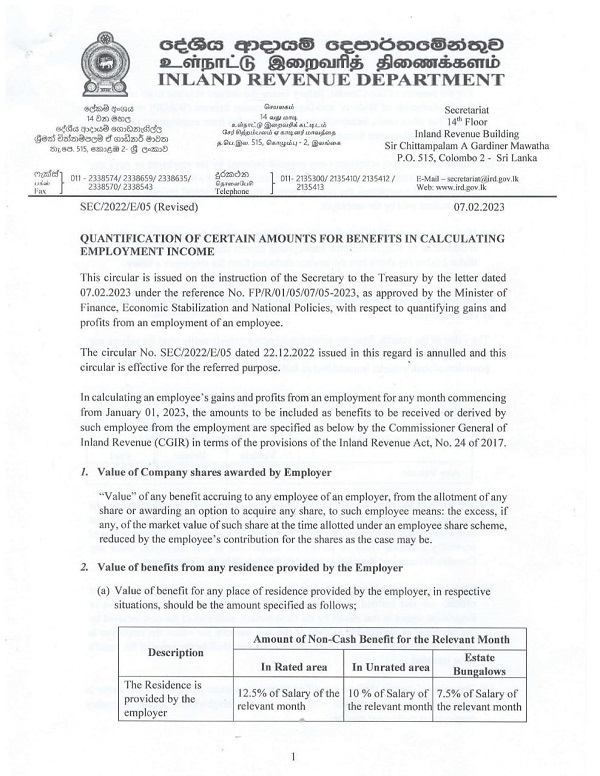

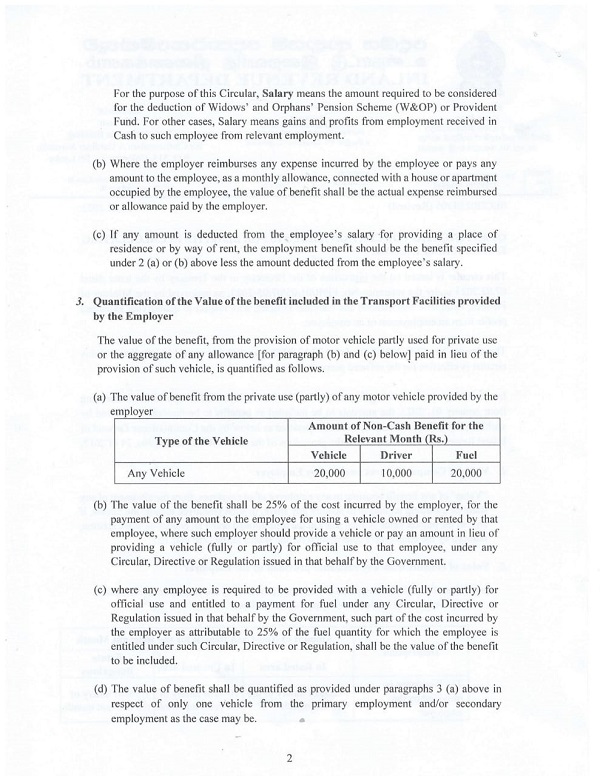

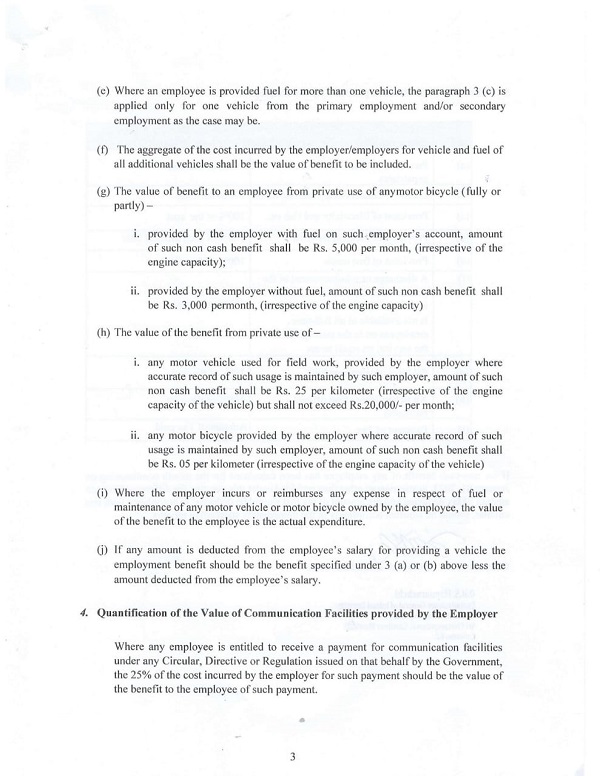

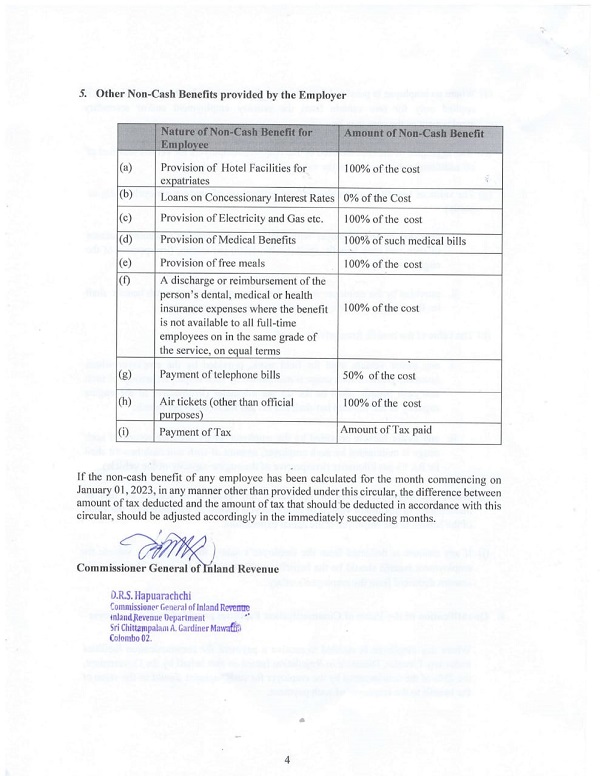

As per the revised circular, the benefits primarily include company shares, residence, transport facilities, communication facilities, and non-cash benefits provided to an employee.

The calculation of an employee’s gains and profits for any month commences on January 01, 2023, according to the circular.

The amounts to be included as benefits to be received or derived by such employee from the employment are specified by the Commissioner General of Inland Revenue (CGIR) in terms of the provisions of the Inland Revenue Act, No. 24 of 2017.

The revised circular has been approved by President Ranil Wickremesinghe in his capacity as the Minister of Finance.

Meanwhile, State Minister of Finance Ranjith Siyambalapitiya has confirmed that the Department of Inland Revenue has issued a circular to exempt noncash benefits of employees’ income from the Pay-As-You-Earn (PAYE) Tax.

“The Inland Revenue Department has issued a circular to exempt noncash benefits of employees’ income, including vehicle & fuel allowances, housing, medical benefits etc. from the PAYE tax,” State Minister Siyambalapitiya told Ada Derana. (NewsWire)