Sri Lanka’s Inland Revenue Department has issued a reminder on the necessary tax-related requirements coming into effect from January 01, 2024.

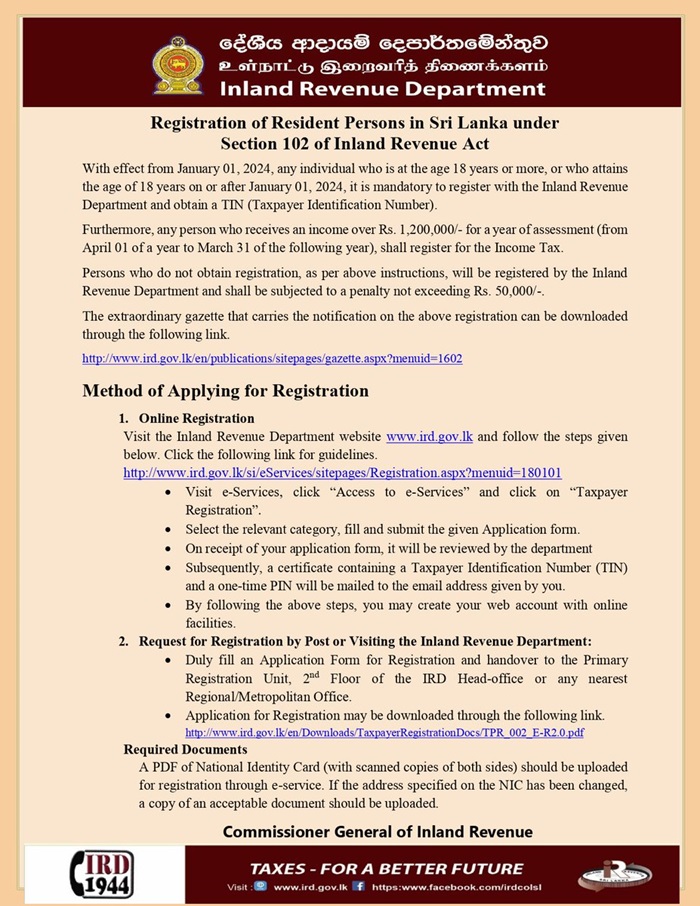

Issuing a notice, the department said it is mandatory for any individual who is at the age of 18 years or older to register with the Inland Revenue Department and obtain a Taxpayer Identification Number (TIN).

Furthermore, any person who receives an income of over Rs. 1.2 million for a year of assessment (April 01 of a year to March 31 of the following year), shall register for the income tax.

The Inland Revenue Department warned that persons who do not obtain registration as per the above instructions will be registered by the department, and shall be subjected to a penalty not exceeding Rs. 50,000.

The department has also urged the eligible persons to ensure to register as required, adding that the registration can be done by adhering to the steps outlined on its official website; http://www.ird.gov.lk/en/eservices/sitepages/registration.aspx?menuid=180101 (NewsWire)