Two international companies have pre-qualified as bidders for the divestiture of the Sri Lankan Government’s shares in Sri Lanka Telecom PLC.

According to the State-Owned Enterprises Restructuring Unit of the Ministry of Finance, the two companies are Jio Platforms Ltd, Gujrat, India and Gortune International Investment Holding Ltd c/o Capital Alliance Limited.

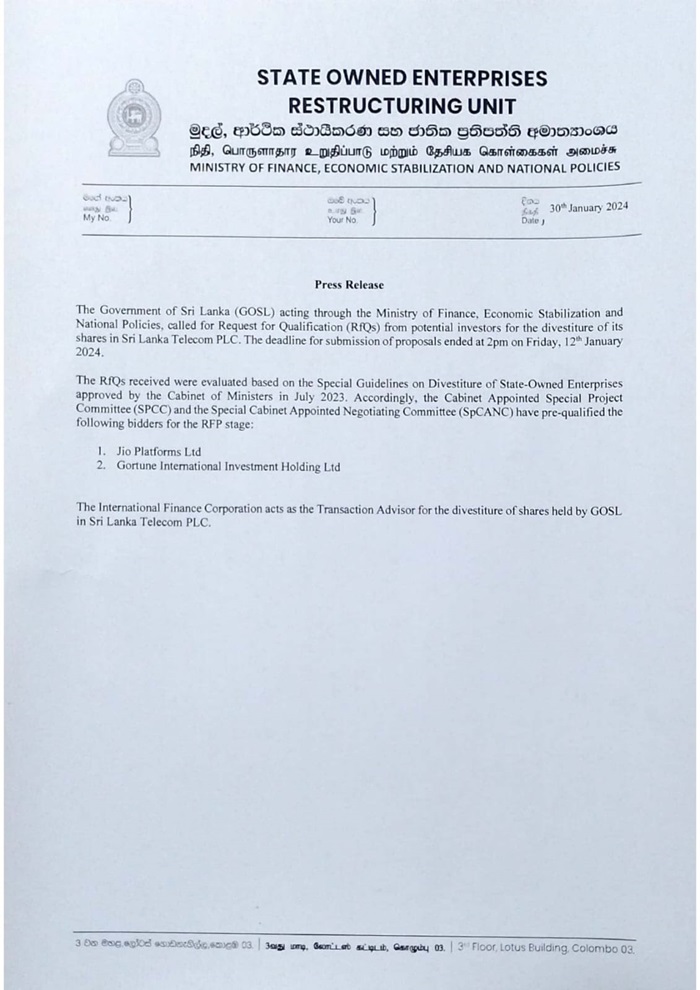

The State-Owned Enterprises Restructuring Unit said in a statement that the Government acting through the Ministry of Finance called for a Request for Qualification (RFQ) from potential investors for the divestiture of its shares in Sri Lanka Telecom PLC. The deadline for submission of proposals ended at 02.00 pm on Friday, 12th January 2024.

The Request for Quotes (RFQ) received was thereafter, evaluated based on the Special Guidelines on Divestiture of State-Owned Enterprises approved by the Cabinet in July 2023.

Accordingly, the Cabinet Appointed Special Project Committee (SPCC) and the Special Cabinet Appointed Negotiating Committee (SpCANC) have pre-qualified two bidders for the Request for Proposal (RFP) stage.

Among the selected pre-qualified bidders, Jio, part of Mukesh Ambani’s Reliance Group, is a strong contender, valued at $107 billion by brokerage BofA, while Gortune International Investment Holding is a private equity firm out of China’s southern hub – Guangdong province.

Meanwhile, Pettigo Comercio International LDA c/o NDB Investment Bank Ltd, a front for UK’s Lyca Group owned by Lankan-born entrepreneur Allirajah Subaskaran, has failed to qualify as a bidder.

The Sri Lankan Government’s sale of a 50.23% stake in Sri Lanka Telecom has drawn interest from the Indian and Chinese firms.

The International Finance Corporation acts as Transaction Advisor for the divestiture of shares held by the Sri Lankan government in Sri Lanka Telecom PLC. (NewsWire)