Six companies have pre-qualified as bidders for the divestiture of the Sri Lankan Government’s shares in Canwill Holdings (Pvt) Ltd.

According to the State-Owned Enterprises Restructuring Unit of the Ministry of Finance, among the pre-qualified bidders, five are Indian companies, and the remaining is a local company.

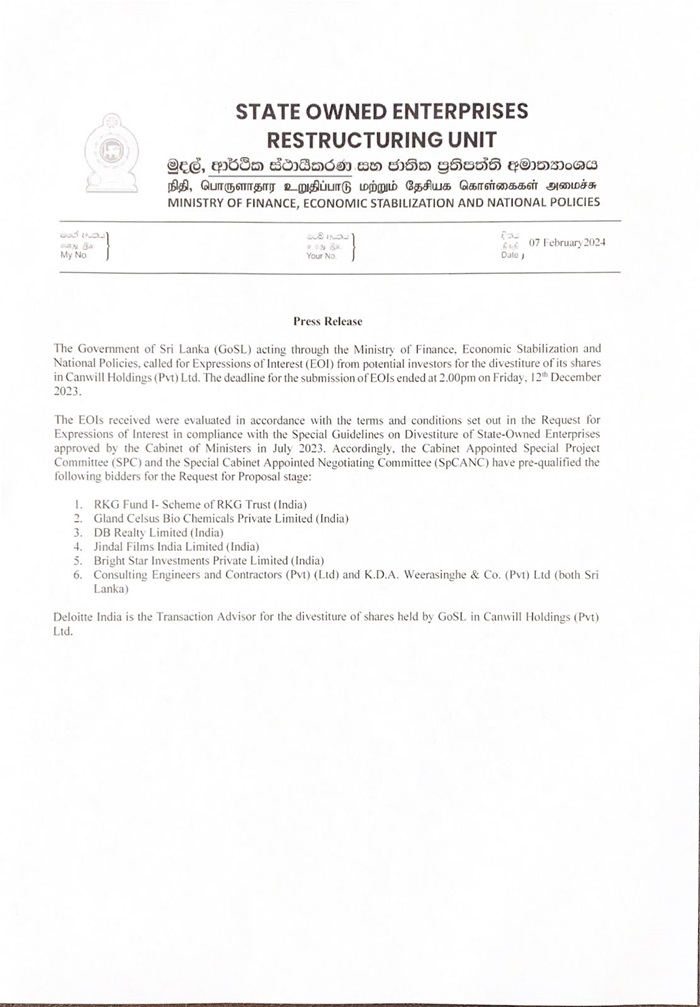

The State-Owned Enterprises Restructuring Unit said in a statement that the Government acting through the Ministry of Finance called for a Request for Qualification (RFQ) from potential investors for the divestiture of its shares in Canwill Holdings. The deadline for submission of proposals ended at 02.00 pm on Friday, 12th December 2023.

The Request for Quotes (RFQ) received was thereafter, evaluated based on the Special Guidelines on Divestiture of State-Owned Enterprises approved by the Cabinet in July 2023.

Accordingly, the Cabinet Appointed Special Project Committee (SPCC) and the Special Cabinet Appointed Negotiating Committee (SpCANC) have pre-qualified two bidders for the Request for Proposal (RFP) stage.

Deloitte Touche Tohmatsu India (Deloitte India) acts as Transaction Advisor for the divestiture of shares held by the Sri Lankan government in Canwill Holdings (Pvt) Ltd.

Canwill is the parent company of Sinolanka Hotels & Spa (Pvt) Ltd (Sinolanka) and Helanco Hotels & Spa (Pvt) Ltd (Helanco).

Sinolanka owns an under-construction top-tier landmark hospitality asset in Colombo, built to Grand Hyatt specifications since Sinolanka entered into a hotel management agreement with Hyatt International- Southwest Asia Ltd in 2012.

The property features an impressive 47-story structure with 458 rooms and an additional 100 serviced apartments, all situated on 2.32 acres of prime oceanfront real estate. The total built-up area encompasses a vast 1,340,562 square feet.

On the other hand, Helanco holds 9.42 acres of beachfront leasehold land in the southern city of Hambantota. (NewsWire)