In an era where traditional savings alone no longer guarantee financial security, the methods we use to grow our wealth must evolve with the times. Today as the world celebrates ‘World Thrift Day’, the fundamental principle of thrift – careful management of money – presents a reminder of the importance of financial prudence, savings, and investments in achieving long-term financial security. The day also serves as an ideal opportunity to reflect on our own financial habits and given the changes in the financial environment, which demands more dynamic strategies to grow wealth, consider how we can make our hard-earned money work harder for us.

The limitations of traditional savings

For generations, Sri Lankans have relied on conventional savings accounts as their primary wealth-building tool. This approach served our parents and grandparents well in times of higher interest rates and lower inflation. However, today’s economic realities present new challenges that require fresh solutions.

Today’s economic realities paint a different picture. When money sits in a traditional savings account, it is losing value over time due to inflation. The purchasing power of saved rupees gradually diminishes, even as the numerical value remains the same. The silent erosion of wealth means that savers need to look beyond conventional approaches to secure their financial future. Savings alone are no longer sufficient to build long-term wealth.

Inflation acts as a silent but persistent force that gradually erodes the purchasing power of our saved money. Over a decade, savings could lose nearly 40% of their real value if left in a traditional savings account offering minimal interest rates.

Traditional savings accounts typically offer interest rates that barely keep pace with, let alone exceed, inflation rates. It means that while your account balance might be growing nominally, your money’s real value could be shrinking. In essence, playing it too safe with your money could actually be putting your financial future at risk.

The power of Capital Markets

Capital markets are financial markets where long-term debt or equity-backed securities are bought and sold. These markets facilitate the exchange of funds between suppliers (such as banks and investors) and those in need of capital (such as businesses, governments, and individuals).

Capital markets serve as the backbone of modern investment opportunities, where financial instruments are traded. The capital markets offer a sophisticated yet accessible solution. Today, capital markets serve as a bridge between those seeking to grow their wealth and various investment opportunities, from government securities to corporate stocks.

Capital markets are divided into two main categories:

- Primary Markets – Where new securities are issued and sold for the first time.

- Secondary Markets – Where existing securities are traded among investors.

Capital markets offer several benefits to new investors:

Capital markets offer an attractive option for new investors looking to grow their wealth and achieve their financial goals accessing a wide range of investment options, including stocks of the listed companies, Treasury Bills and Bonds, Corporate debt securities and unit trusts, enabling them to diversify their portfolios. Compared to traditional savings accounts, capital markets often provide opportunities for higher returns on investments and importantly, investors can buy and sell securities relatively easily, providing flexibility and access to their funds when needed.

Capital markets are regulated and provide a wealth of information, helping first-time investors make informed decisions. They can especially benefit from the expertise of professional investment managers.

Investment Options in Capital Markets:

The capital markets offer various investment vehicles, each suited to different financial goals and risk appetites:

Fixed Income Securities – Government Securities, Treasury Bills, Treasury Bonds. Minimum investment often starts from LKR 100,000.00. Risk level is generally lower and suitable for conservative investors seeking stable returns

Equity Investments – Stocks/Shares, Initial Public Offerings (IPOs). Minimum investment varies by stock. Risk level is higher risk with potential for higher returns. It is suitable for growth-oriented investors with longer time horizons.

Unit Trust Funds – Offer professionally managed investment pools with various risk profiles available. Minimum investment begins from as low as LKR 1,000.00. Risk level varies based on fund type and is suitable for novice and experienced investors seeking diversification.

Finding your risk appetite:

Risk appetite often reflects your financial comfort zone. It is about how much uncertainty an investor can handle without losing sleep. Some are comfortable with bigger risks for potentially higher rewards. Others prefer the safer path. An investor’s risk appetite should match their personality, financial goals, and life stage. A young professional might take more investment risks than someone nearing retirement.

Understanding macro-factors – Inflation act as hidden tax on your money. When prices rise, your money buys less than before. Therefore, keeping all your money in a regular savings account can make you poorer over time. Smart investing means choosing options that help your money grow faster than inflation eats it away.

Reading economic and interest rate cycles – Think of the economy similar to seasons – it goes through predictable cycles. When interest rates are low, it is usually good for stocks but not great for fixed income investments. When rates rise, fixed income investments become more attractive. These cycles affect different investments differently. Money market funds might be perfect for short-term needs during high interest periods, while equity funds might be better when the economy is growing strongly.

Making the Right Choice in investment timeframes – Success in capital markets requires a structured approach based on your time horizon:

Short-term (under 1 year) – Money market unit trust funds and short-term government securities keep money in a secure but slightly more rewarding place than a savings account. Ideal for emergency funds and near-term financial goals.

Medium-term (2-5 years) – It is balance between decent returns and stability. Ideal mix of fixed income and moderate-risk equity unit trust funds. They balance decent returns with moderate risk, perfect for goals such as education or property down payments.

Long-term (5+ years) – These have a greater emphasis on growth as there is a higher allocation to equity unit trust funds. They provide better returns over longer periods and are appropriate for retirement planning and wealth building.

Unit Trust Funds as the smart alternative

For many individuals, directly navigating these markets can seem daunting and time-consuming. This is where Unit Trust Funds emerge as a powerful alternative, combining the security of professional management with the potential for higher returns than traditional savings accounts.

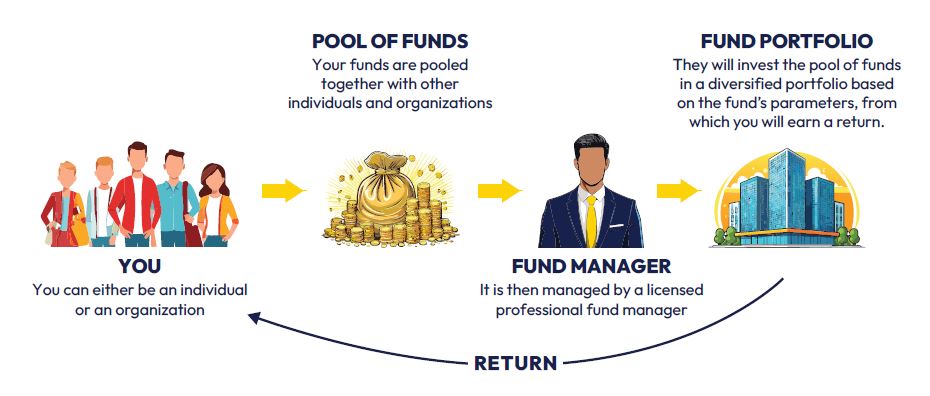

In a simpler explanation, Unit Trust Funds are a collective investment scheme that is a pooling vehicle of your funds with other investors and organizations. The fund is managed by a licensed and professional fund manager who creates a diversified portfolio based on the fund’s parameters to earn a return. As a new investor understanding the differences helps you make smarter choices.

The difference between Unit Trusts vs. Savings Accounts – Understanding the differences helps you make smarter choices about where to put your money based on your goals: keeping cash readily available or building long-term wealth.

When it comes to managing your money, savings accounts and unit trusts as two very different tools. A savings account keeps your money secure and accessible but does not help it grow beyond inflation most of the time. It is perfect as an emergency fund or for daily expenses, but in today’s economy, it is not enough to build real wealth.

Unit trusts takes your money on a journey of growth making it work in the market. It works by pooling your money with other investors and putting it in the hands of professional fund managers. Through safer options such as money market funds or more growth-focused choices including equity funds, investors receive the benefit of professional management without needing to be a financial expert. Your money has a better chance of growing over time, opening doors to potentially higher returns that could help money grow faster than inflation.

Is Unit Trusts the right investment choice for you?

Investing in Unit Trust Funds can be a strategic decision for those looking to grow their wealth beyond traditional savings accounts. However, there are some key considerations to help you determine if Unit Trust Funds are the right choice for you.

Are my savings keeping up with inflation? Traditional savings accounts often fail to keep pace with inflation, leading to a gradual loss in purchasing power. Unit Trust Funds, on the other hand, aim to provide returns that outpace inflation. Investing in a diversified portfolio managed by professional fund managers, will help to potentially achieve higher returns that ensure your money grows over time.

Am I looking for attractive returns than my savings account? If you are seeking better returns than what your savings account offers, Unit Trust Funds can be an attractive option. These funds invest in a variety of assets, including stocks, bonds, and other securities, which can offer higher yields compared to the interest rates on savings accounts. However, it is important to remember that higher returns come with higher risks, so it is crucial to choose funds that align with your risk tolerance.

Are there Unit Trust Funds suited to my risk appetite? The Unit Trust industry offers a wide range of funds designed to suit different risk appetites. Whether you are a conservative investor looking for stable returns or an aggressive investor seeking higher growth potential, there are funds tailored to your needs. It is important to assess your risk tolerance and investment goals before selecting a fund.

Do I want expert Fund Managers to handle my investments? If you prefer to have your investments managed by professionals, Unit Trust Funds are an excellent choice. Fund managers are experienced in navigating the financial markets and use their expertise to make informed decisions on behalf of the investors. It can be particularly beneficial for those who may not have the time, knowledge, or inclination to manage their investments actively.

The growing success of Unit Trusts

India – India’s unit trust journey began in 1963 with the Unit Trust of India (UTI). What started as a single fund has transformed into a thriving industry, powered by digital innovation and growing financial awareness. The numbers tell an impressive story – from INR 10 trillion in 2014, the industry’s Assets Under Management (AUM) doubled to INR 20 trillion by 2017 and reached INR 30 trillion in 2020. Today, it stands at an impressive INR 66.70 trillion (August 2024) – a sixfold increase in just a decade.

Investor participation has grown equally impressively. The number of investor accounts more than doubled from 8.53 crore in August 2019 to 20.45 crore by August 2024, with nearly 20 lakh new accounts added monthly. The outstanding growth reflects an increasing investor confidence and the industry’s success in making investments more accessible to Indians.

Sri Lanka – The unit trust industry in Sri Lanka has shown impressive growth since its introduction in 1991/92. With a 6-year Compound Annual Growth Rate (CAGR) of 39%, the industry has expanded significantly. Between 2019 and 2024, it grew from LKR 65 billion to LKR 470 billion as of 31st March 2024. By September 2024, it had crossed the LKR 500 billion mark, making it a half-trillion industry

The growth is not limited to the industry’s size alone. The investor base has also expanded, growing from 42,000 to 100,000 investors. The increase in participation indicates a growing interest in unit trust investments among Sri Lankans.

The Securities and Exchange Commission of Sri Lanka (SEC) regulates the unit trust industry, ensuring that it operates within a robust regulatory framework. The regulatory oversight helps to maintain investor confidence and supports the industry’s continued growth.

As the industry continues to evolve, it is expected to play a more significant role in the Sri Lankan financial market, offering investors diversified investment options and the opportunity to achieve higher returns compared to traditional savings accounts.

Choosing the right Unit Trust Fund for you

Understanding different types of Unit Trust Funds is important for making informed investment decisions:

Income Fund – is aimed at providing higher returns than fixed deposits with moderate risk. With a time period of 1-2 years, it is suitable for investors who seek a higher interest rate while keeping risk at a moderate level.

Money Market Funds – These are short-term government securities and corporate bonds that mature within one year providing higher returns than savings accounts while ensuring capital security. As the period is less than 1 year is it suitable for investors looking for a short-term investment option with low risk and stable returns.

Gilt-Edged Funds – Invests exclusively in government securities to secure capital with stable returns. A short to medium-term period it is suitable for investors with a low-risk appetite, seeking a safe investment with capital preservation.

Equity Funds – Invest primarily in stock market securities and provides high returns over the long term by investing in company shares. With 5-10 years periods, it is suitable for investors with a high-risk appetite who are looking for high returns over the long term.

First Capital’s commitment to grow the Unit Trust industry

First Capital continues to be in the forefront to grow the Unit Trust industry in Sri Lanka. Through innovative strategies First Capital has helped break down traditional barriers to investment, making it easier than ever for individuals to begin their investment journey.

Digital Innovation – First Capital has pioneered complete digital onboarding in Sri Lanka, launching a paperless, remote account opening system through their user-friendly platform at https://eonboarding.firstcapital.lk/. The innovative solution enables investors to join and manage unit trust funds from home, streamlining document submission and investment processes.

Additionally, the First Capital Invest App and online portal offers users real-time insights into; the performance of their investment portfolio, government securities, stocks, debentures, and research, with a customizable watchlist feature available on both Android and iOS devices. These digital tools are transforming investment management, offering convenience and comprehensive information for investors worldwide.

Revolutionary service via WhatsApp – For the first time in Sri Lanka, individuals can invest and withdraw Unit Trust Funds through WhatsApp, making their investment journey seamless. The revolutionary service also includes New Investment Requests, Withdrawals from Funds, Fund Balance Inquiries, Receive information know about the latest Unit Price details and Request for Debit Cards to access the fund.

Instant access to funds via debit cards – Investors of the First Capital Money Plus Fund can receive instant liquidity through a debit card issued by Hatton National Bank PLC and they act as a trustee to this fund. The feature enables investors to withdraw cash from ATMs nationwide and make online payments with ease.

Market Awareness and Education – First Capital undertakes increasing market awareness and educating sessions via online and physical streams for potential investors about the benefits of capital markets, investment options and strategies and unit trust investments. Education includes highlighting the potential for higher returns compared to traditional savings accounts and the role of professional fund management in achieving financial goals.

First Capital has achieved significant milestones in the unit trust industry, demonstrating leadership and commitment to excellence

Surpassed LKR 100 Bn AUM – First Capital has successfully grown its Assets Under Management (AUM) to over LKR 100 billion. The substantial milestone reflects the trust and confidence investors have in First Capital’s management and investment strategies. It also underscores First Capital’s ability to deliver consistent returns and meet the diverse needs of its investor base.

Awards and recognition – The company’s dedication to excellence has been recognized through prestigious awards. Notably, the First Capital Money Market Fund won the Silver award for the ‘Best Unit Trust Fund at the Capital Market Awards organized by the CFA Society. The recognition highlights the fund’s exceptional performance and the quality of its management. It also demonstrates First Capital’s ability to deliver superior returns while maintaining the highest standards of professionalism and integrity.

Industry innovations – First Capital has been at the forefront of industry innovations, introducing revolutionary features such as debit card access to unit trust funds. The unique offering provides investors with unparalleled convenience and flexibility, allowing them to access their funds instantly. The innovation has set a new standard in the industry, enhancing the overall user experience and accessibility of unit trust investments.

Compliance with CFA Asset Manager Code – First Capital has demonstrated its commitment to ethical and professional standards by adhering to the CFA Asset Manager Code. The compliance ensures that First Capital’s investment practices are transparent, fair, and in the best interest of its investors. It also reinforces First Capital’s reputation as a responsible and trustworthy asset manager.

First Capital’s innovative approach to unit trust investments, combined with its strong track record and commitment to customer service, provides an excellent platform for novice and experienced investors to begin their investment journey.

Start your investment journey today and be part of the growing community of smart investors who have moved beyond traditional saving and are building their wealth through Unit Trust Funds. For more information, contact First Capital Holdings 0112651651 or visit their digital platforms. The time is now – your financial future depends on it.

Disclaimer: Unit Trust Investors are advised to read and understand the contents of the Key Investor Information Document (KIID) before investing